-> My Collection; The whole book can be seen here as an Image Only Album, or direct to the page of this text here.

(page 28-30)

Greater profits are to be made from mining enterprises than any other. This has been proved by carefully prepared statistics of the United States government. This has been true of past operations in mining and should be more than true of future operations for mining is now conducted on a more scientific basis and under far more favorable conditions than ever before. You will always find those who will tell you that mining is only a gamble, but this is not more true of mining than any other industry.

The farmer plants his grain in the spring time and it is a gamble as to whether he will get any returns. Too many people are like the man in the fable who would not sow his grain, believing there was going to be a drought and he would lose his seed. This is the foolish man and not the one who takes the necessary risks.

Strong Mine at Victor.

Strong Mine at Victor.

According to the United States Geological Bureau over $1,000,000,000 were produced by the mines of the United States in 1903. Did it ever occur to you that the entire population of the Rocky Mountain region, which made this production, including Montana, Wyoming, Colorado, New Mexico, Arizona, Utah, Idaho, Washington, Oregon, Nevada and California, does not exceed the population of Greater New York city or Chicago? No Eastern community can show such an output in proportion to population.

Those who claim that mining is a gamble should look into these facts, which can easily be secured from reliable sources. Where is the single industrial corporation that can show the profits of the Calumet and Hecla, which has distributed among its stockholders over $83,000,000?

In 1893 the stock of the Gold Coin of Cripple Creek sold as low as one per cent. per share. This company started with a bond and lease on the Gold Coin claim. Seven years later this stock sold as high as $6.50 per share.

The Comstock lode of Virginia City, Nevada, produced about $400,000,000, and most of the ore yielded but $8 per ton in gold.

The Anaconda mine of Butte, Montana, was sold for $40,000,000 to the Amalgamated Copper company.

The Alaska-Treadwell, with ore running less than $3 per ton, has paid over $5,000,000 in dividends.

The Granite Mountain has paid $15,000,000.

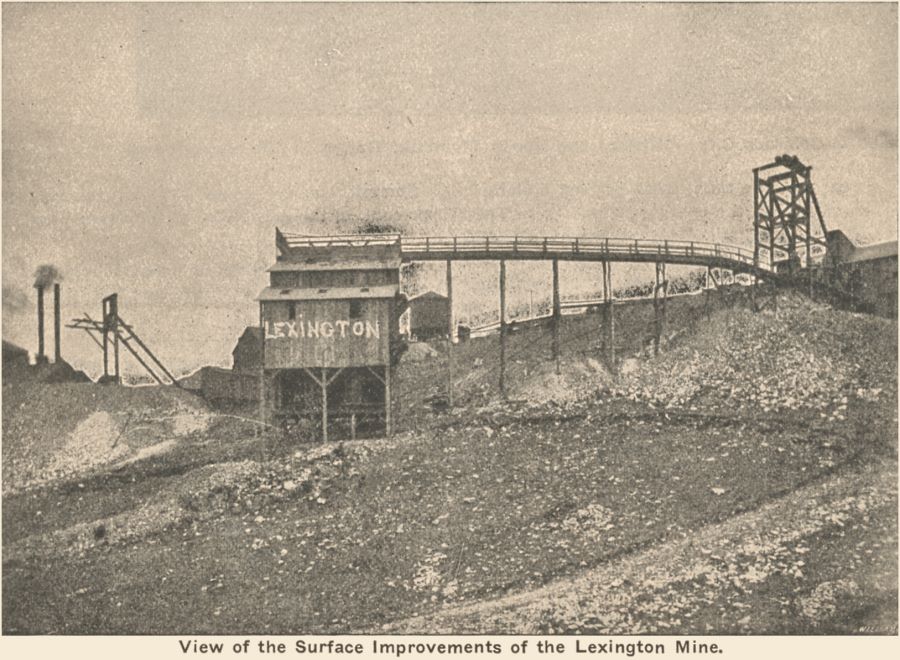

Lexington Mine - aka

Lexington Mine - akaClara D. on Gold Hill.

The Homestake of South Dakota, on ore running less than $4 per ton, has paid $3,333 in dividends every day it has run for the past ten years.

The United Verde of Arizona has paid in the last few years $11,000,000 in dividends and has opened up the largest copper deposits in the world. It is claimed that this property is worth $100,000,000.

The Copper Queen of Bisbee, Arizona, a newly developed mine, has within the past few months started a production of about $1,000,000 per month.

These are the records of the great mines of the Rocky Mountain region, which should be satisfactory evidence of the money to be made in mining.

The Calumet and Hecla has paid, as stated before, over $83,000,000 in dividends, which is the largest amount of dividends ever paid by any single corporation in the world, be it mining or industrial.

The Boston and Montana. Amalgamated Copper and Anaconda have paid from twenty to twenty-five millions each. While the past for copper has been very bright, I believe the future to be brighter, for the increase in the consumption of copper during the next ten years will undoubtedly surpass all records.

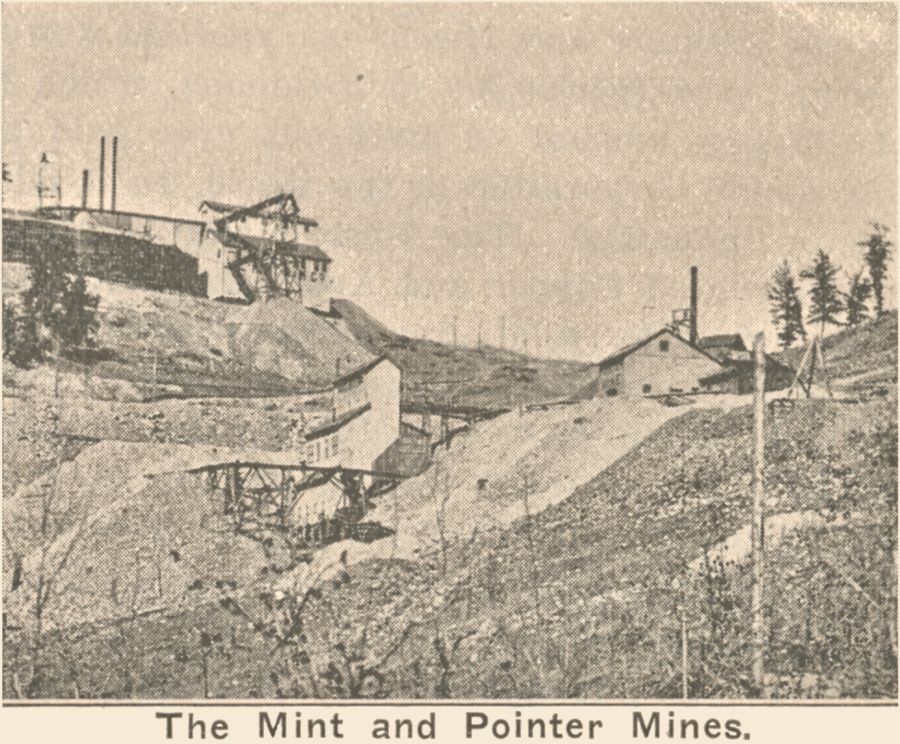

Pointer Mine (lower) &

Pointer Mine (lower) &Mint aka Index (up left).

There is no need for the investor to be led astray, as so many have been in the past, in making a mining investment. Too many have been allured by the promise of dividends. This has been allowed to blind the investor's investigation of the essential points of merit. During the past few years the promoters who have placed the most stress on the payment of dividends and who have made the most exaggerated statements have been the ones who have sold the stock. The essential elements making up a safe mining investment are as follows:

It should first be known that the company is to be managed by men of honesty and integrity. Many of the propositions before the public are only stock jobbing schemes of promoters whose chief objects is in making money out of the stock. Be sure the men in whom you place your confidence are men who are willing to risk their money and who are expecting to make their profits out of the mine.

Be sure the promoters are mining men of experience. I see schemes presented in advertisements and circulars every day which come from Eastern promoters, who never saw a mine and who are no more capable of judging or operating a mine than a farmer would be capable of running the United States Steel Corporation, or than I would be of making a watch. If you want a watch made you naturally will go to a watchmaker. Then, if you want a mining investment, go to a mining man.

—Rocky Mountain Magazine.