-> Found at Hathi Trust Digital Library website, link to page.

Source had no images, so I added some from my collection.

By W. W. TRAVELL.

It must be admitted that the Portland mine now stands as the Independence did some four years ago, when the consulting engineers to that company advised the London office to introduce the leasing system—that is, the Portland is very much of a shell.

Its main orebodies, like those of the Independence, are worked out, the average grade of the ore cannot be much more than $16 per ton, and, although the Portland company has its own mill at Colorado City, the profits must necessarily be small, owing to the great amount of waste, large expense of timbering, long tramming distances, and the very low grade of the ore. One must not, however, lose sight of the fact that in this mine the line of contact with the granite, pitching as it does from the Independence north end into the Portland, will give pay-ore at a much greater depth than in the Independence.

On the latter property Mr. Hammond carried the shaft down to the 1400-ft. level, and did much driving and cross-cutting at that depth, without finding any ore better than $3 or $4 per ton. The pay-ore below 1100 ft. seems to have been cut off at the contact.

The Portland may continue to do fairly well a little deeper than this, although, as before stated, the ore seems, on Battle Mtn., to become poorer in depth. The company undoubtedly has a valuable asset in the dumps; these cannot be less than 1,500,000 tons, and remembering the fact that the Portland company, for years, never leased or washed the dumps, the average value of the whole should not be less than $4 per ton. This is a considerable item.

It is known that the company has been experimenting on the dump ore for some time at Colorado City, and is now erecting a small plant (10-stamp mill) near the mine. They are proceeding carefully, spending probably not more than $15,000 on the outfit.

The method will be to convey the ore automatically to the mill for crushing, pass it over concentrating tables, and then cyanide. The tailing will be put over a second table. It is reported that they are going to very little expense in the matter and are obtaining the most up-to-date tables; by reason of many years of experience in milling their oxidized ores at Colorado City they should be able to devise the best and cheapest means for treating the dumps.

It would seem wise, judging by the experience of the Stratton's Independence company, to lease the upper levels of the property, instructing their superintendent to watch the timbering and attend to the general supervision of the lessees.

Twenty or thirty sets of brains are better than one in following and discovering ore, and should the Portland company decide to lease the upper workings, I believe their experience would be even more gratifying than that of the Independence, which, after losing some $50,000 in one year on company account, made a profit next year of $1,000,000—the mine making $500,000 and the lessees, $500,000.

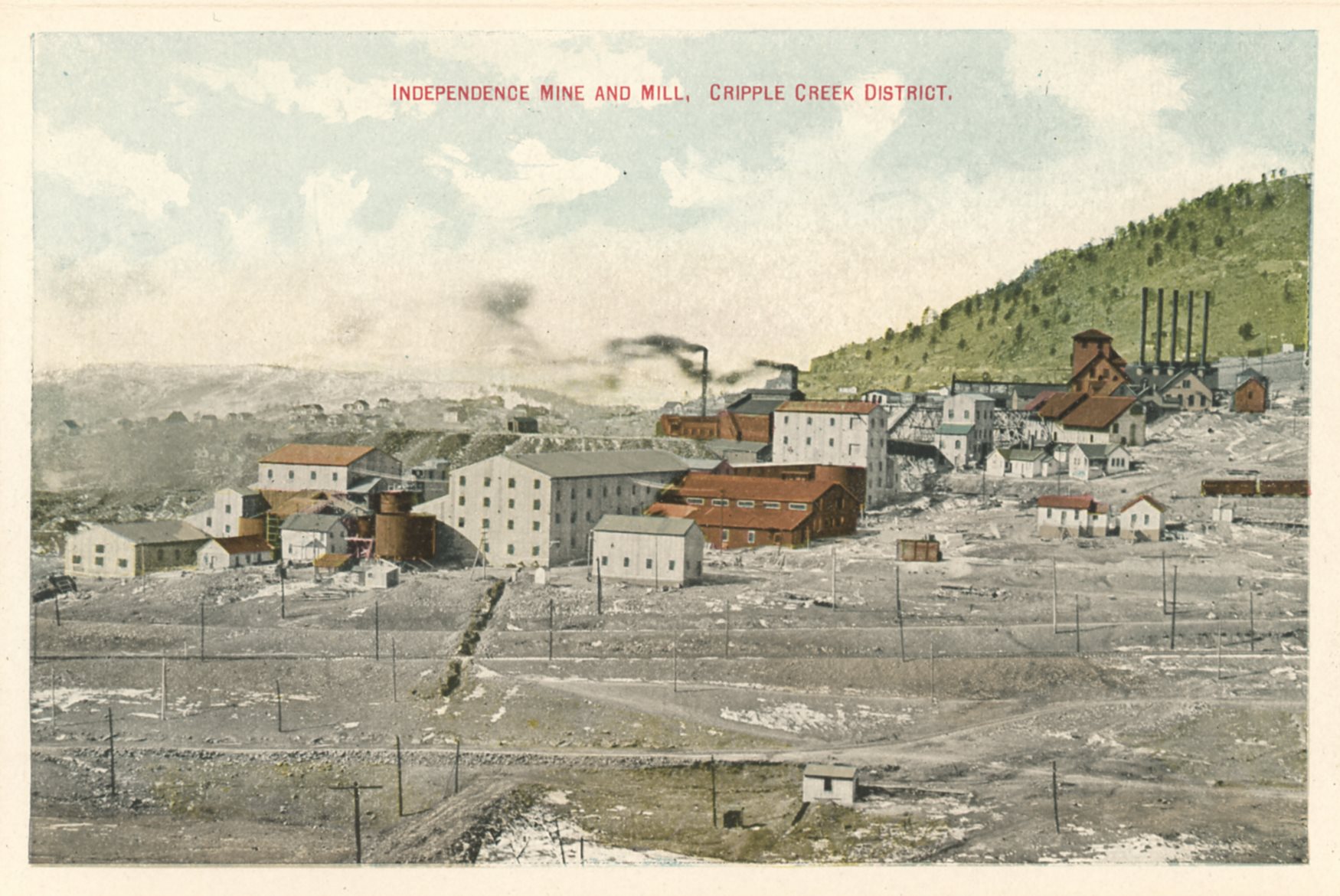

Four years ago the Stratton's Independence mine reached the condition in which I have described the Portland to be, and the consulting engineer wisely decided that the time for leasing had come. His good judgment was only too well proved by the splendid results, both to the lessees and company, since then.

Certainly not less than a million dollars had been made by the company, and a similar amount by the lessees during that time. There was much unfair criticism by the press and public regarding supposed exorbitant charges for royalty, hoisting, air, etc., but time proved that such was not the case; the lessees made an almost equal profit with the company.

It is common knowledge that a lessee can and does work 30% cheaper than a company, to say nothing of having some 30 or 40 alert miners looking for ore. So that when a large mine like the Portland or Independence finds its main orebodies exhausted, with nothing but small stringers, an occasional pocket to find, and mainly development work to do, it is well to lease the workings.

The Independence is now in its secondary stage, that is, where the lessees have practically cleaned out all the pay-ore, although there are still some fourteen sets of lessees making a little money for themselves, and a little for the company. It has been deemed wise to make a further change. There are many thousands of tons of ore running from $5 to $10 per ton in the mine, and undoubtedly much of better value would be exposed if a system of caving were adopted, for whenever caves have occurred in the mine good ore has been opened up.

Experiments having shown that refractory ores of low grades can be mined and milled at a profit, the management decided to build a mill for this purpose. Moreover, after being most thoroughly sampled by George A. Schroter, who put down some 25 shafts all over it, taking waste and ore just as it came from the shafts and crushing and sampling it, and reducing all assays to $6 per ton, the dump showed an average value of $3.75 per ton.

Some 700,000 tons of ore averaging not less than $4 per ton must be on these dumps, and Philip Argall, who has spent some $300,000 on an elaborate mill, will now have an opportunity to show what can be done toward the successful treatment of this immense tonnage.

From the data given by Mr. Argall, his cost of extraction should not exceed $2.75 per ton, so that if Mr. Schroter's figures are correct (and we have every reason to believe that they are) this would leave a net profit on the dump alone of about $700,000.

As we understand that the company in London has, under a re-organization scheme, raised the necessary funds to pay off all machinery and other debts, leaving a handsome sum on hand to enable Mr. Argall to push his tests to completion, we may reasonably hope to hear of definite results within the next two months.

Should the mill prove to be a success it will mean much for Cripple Creek, as there are immense tonnages of low-grade ore in most of the larger mines, and many of the smaller ones, and it will give a stimulus to the camp for many years, besides increasing the possibilities of opening up higher-grade ore while working on the poor stuff.

The Golden Cycle mine has been one of the steadiest and largest producers in the camp for many years, and the great help given to the Cripple Creek district by J. T. Milliken in building an 800-ton mill at Colorado City and treating (in addition to the Golden Cycle ore) custom ore, cannot be over-estimated.

Their rate of $4.50 for freight and treatment on $8 ore was the means of making the camp look like 'old times' again, for almost every property with anything in sight, commenced operations either under lease or company account, and everyone was looking for leases in the mines or on the dumps.

The United States Reduction & Refining Co., to meet this competition, put down their rates even lower than the Golden Cycle, making a $3.50 rate on $8 ore (though they have since raised this twice during the last three months), thus more than ever stimulating development work all over the district.

Unfortunately many lessees shipped thousands of tons of dump ore that ran close to $4, leaving the Reduction company but little margin for loss, hence their reasons for putting up their rates to discourage the shipment of ore running under $10 per ton. However, the good work done by the Cycle people is highly commendable, and has been the means of bringing the camp back to a good monthly tonnage.

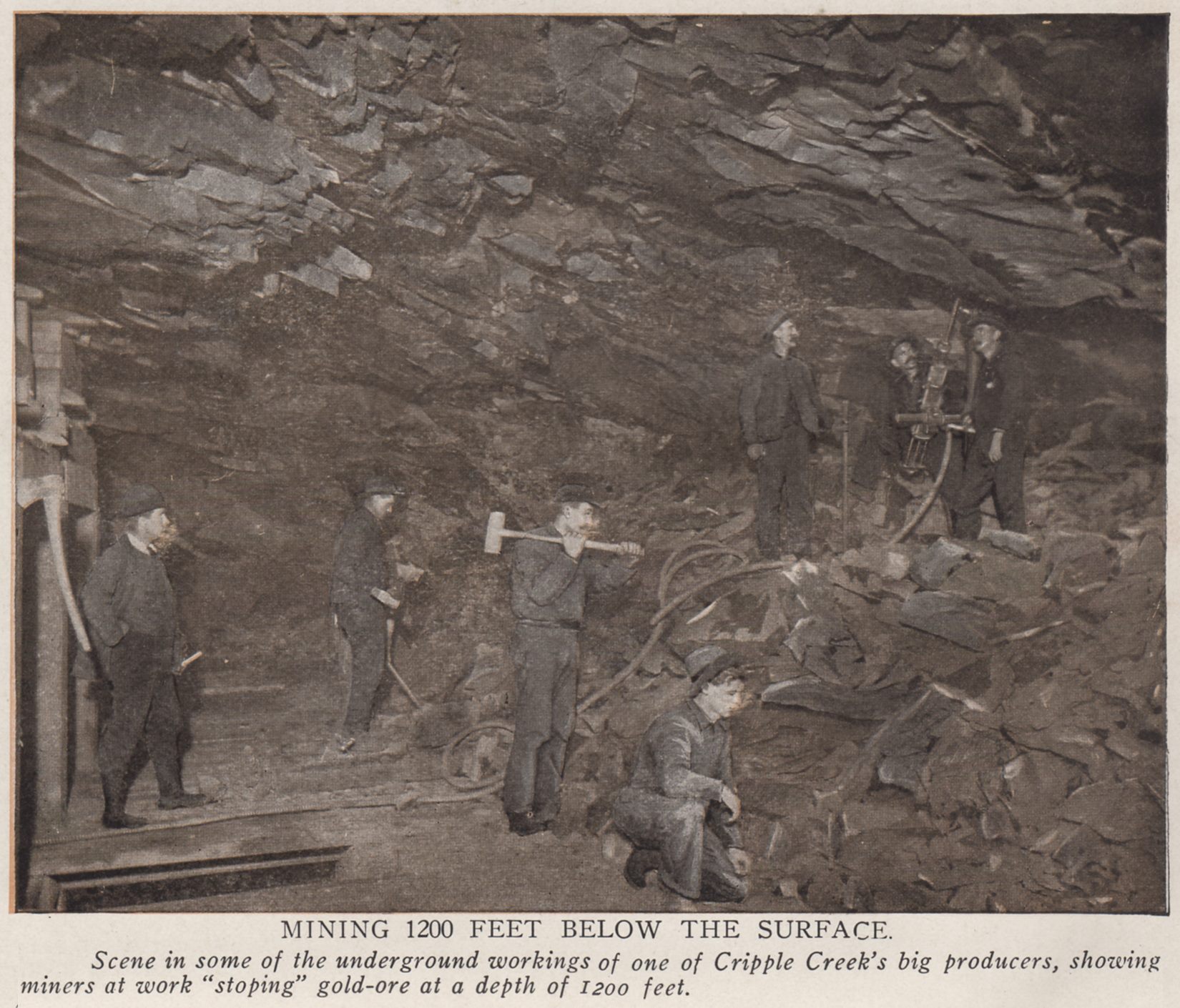

The Cycle property is now working at a depth close to 1400 ft. and yields about 150 tons per day of ore averaging close to an ounce. This mine differs from the Portland and Independence in that much of its better grade of ore is found in the lower levels, having immense bodies of its highest-grade ore at 1200, 1300, and 1400 ft. I consider the Cycle good for a tonnage of 150 ounce of ore per day for many years, with great possibilities in their lower levels.

The ownership of reduction works is a feature that will enable this company to continue production when their ore becomes much lower in grade.

The Elkton mine is producing about 2000 tons per month of good-grade ore, probably an average of $25 per ton. I consider the Elkton one of the best properties in the Cripple Creek district, with possibilities of a long life. Large bodies of ore of grade better than an ounce exist at the lower levels.

At 900 ft. (just about water-level) an excellent showing is being developed, and with the completion of the drainage adit large bodies of high-grade ore will be exposed that have been covered during the last few years since pumping operations on the lower levels ceased.

A large tonnage of good-grade ore will undoubtedly be shipped from this property for many years.

The Cresson mine is also steadily yielding ore averaging close to an ounce. At present some development work is being done, so that the tonnage is not as large as usual, being in the neighborhood of 1500 tons per month.

The Dante, Trilby, Blue Bird, Gold Sovereign, and their neighbors have excellent showings and are making a fair output. The Dante is the best of these, producing about a car per day of ore averaging $20 per ton.

The Isabella is not doing quite as much as usual, but the cyanide mill seems to be successful with the dump ore, and as this property from the 100 to 700 ft. is in the oxidized zone, there should be no trouble in treating many thousands of tons of ore too low to send to the reduction works.

Work is progressing satisfactorily on the drainage adit, some 4000 ft. having been driven, and an average of about 12 ft. per day is being maintained. With the completion of the adit, the El Paso, Elkton, Portland, Strong, and many other properties will undoubtedly be greatly benefited, so that, taken as a whole, the camp should be a producer for many years yet of, say, some 40,000 or 50,000 tons per month of ore of an average grade of $15 to $20 per ton.

The Vindicator mine has been one of the large producers of the camp and, at present, is worked almost entirely by lessees. Some of the richest ore found in Cripple Greek has been taken from this property, and many of the lessees have done exceptionally well. I consider it will be a steady shipper for many years yet, with possibilities of opening up additional orebodies under the leasing system. The main ore-shoots have been worked out, but much good territory remains undeveloped.

A steel shaft-house and head-frame 80 ft. high are being constructed at the No. 1 shaft, showing the company's confidence in the continued finding of ore. At present they are making an average production of about 1600 tons per month, and four dividends, amounting to $45,000 each, have been paid since the first of the year.

About the beginning of 1908 the El Paso Gold Mining Co. decided to lease its upper workings, which showed little or no profit under company management, pending the completion of the new drainage adit. Their good judgment has been proved by the majority of the lessees doing well and paying the company fair royalties.

This one mine should become one of the most active producers when the drainage adit is completed, as undoubtedly large bodies of good-grade ore exist in the lower workings.

The Strong mine is one of the steady producers of the district, the ore being almost entirely in the granite, near the contact. There is good ore at depth, and I anticipate production for many years. Several million dollars have been paid to the owners during the past ten years; it is a close corporation, having only three or four owners.

Their present output should not be less than 2500 tons per month of $30 ore.

During the period that the Gold Coin mine, now called the Granite, was owned by the Woods family it produced many million dollars worth of ore. It is, however, practically worked out and, although a few sets of lessees are working, their output is small, and I do not anticipate much from this property, until perhaps such time as the mills can treat the very low-grade ores at a profit.

Although during the past twelve months the output from the Findlay has not been large, I understand that reserves are stored in the stopes and in the lower levels (1200 ft.) good ore is said to exist. Under vigorous management and development work the Findlay should be a steady producer for many years.

The Hull City Placer main workings are merely a shell, but with territory well located and not yet tested. This mine is under lease entirely and will probably produce a fair tonnage for several years.

The Mary McKinney, one of the old mines, is now under lease to the Western Investment Co., which has sub-leased to several sets of lessees. A fair tonnage of moderate grade is being shipped and with the development work now under way, this property should continue to maintain a steady output.

The Doctor Jack Pot, Work, and adjoining properties are producing, chiefly under lease, with prospects of continuation.

The entire Stratton Estate properties, such as the American Eagles, Lucky Gus, Specimen, Sacramento, are under lease and many of them are productive. Several new orebodies have been discovered on the American Eagles. The Lucky Gus, under lease to H. G. Moore and associates, has been one of the best operations in the camp, having paid each of the three lessees some $50,000 during the year, and they are still making a good production of high-grade ore.

Generally speaking, with the necessary development, the properties of this estate should produce a fair tonnage during the next five years.